HARNESSING COLLECTIVE EFFICIENCY AND ADVANCED ALGORITHMS

At Fort, our ability to identify and acquire off-market industrial real estate investments is driven by our innovative use of technology, specifically our data warehouse-powered Deal Sourcing Tool. This tool, rooted in the principle of “collective efficiency”, goes beyond singular decision-making, which can often be suboptimal in the multifaceted world of real estate. By leveraging a sophisticated data warehouse architecture, we’ve created a system that identifies investments meeting specific acquisition criteria, fully integrated with our Fort Operating System (F.O.S.).

So, what exactly is “collective efficiency”? Collective efficiency refers to the synergistic effect achieved when multiple data points, insights, and algorithms are combined and analyzed as a whole, rather than in isolation. By harnessing the collective wisdom of various data points and integrating diverse sources of information, collective efficiency enables a more nuanced and comprehensive understanding of market dynamics, leading to more informed and optimal decision-making. For example, when identifying potential Class B industrial properties for investment, applying the concept of collective efficiency allows us to analyze factors such as location, size, and tenant profiles to find assets that align with our investment criteria.

The application of collective efficiency within our Deal Sourcing Tool allows us to tap into a broader spectrum of insights and opportunities, transcending traditional methods. It’s not just about connecting the dots between potential investments and our unique data and requirements; it’s about redefining how we find and seize the best investment opportunities. This approach not only enhances our ability to navigate the market but also positions us at the forefront of innovation, setting a new standard for excellence in the industry.

THE SIMILARITY MATRIX AND ITS ROLE

Central to our approach is the proprietary similarity matrix. This tool plays a pivotal role in advanced modeling techniques, supercharging deep learning algorithms with data sourced from collective insights. The similarity matrix essentially replicates the intuitive process analysts employ when comparing assets for pricing evaluations. This intuitive process, a natural reflex of the human brain, is a testament to our intricate classification systems. The essence of “sameness” or similarity, though often overlooked, is a complex computation we perform subconsciously.

Drawing parallels from everyday life, consider facial recognition. We instantly recognize family, friends, and colleagues, but what underlies this instant recognition? Beneath the obvious, our brains compare numerous attributes like bone structures, facial dimensions, and even non-numeric features like eye color. This intricate process leads to the immediate recognition of familiar faces.

METHODOLOGY: TRANSLATING HUMAN INTUITION TO ALGORITHMS

Our methodology, rooted in linear algebra, seeks to translate this human intuition into actionable algorithms. Just as we represent facial features in a multi-dimensional space, we can represent industrial assets with their myriad attributes in a similar space. The challenge then is to define and measure “sameness” or similarity.

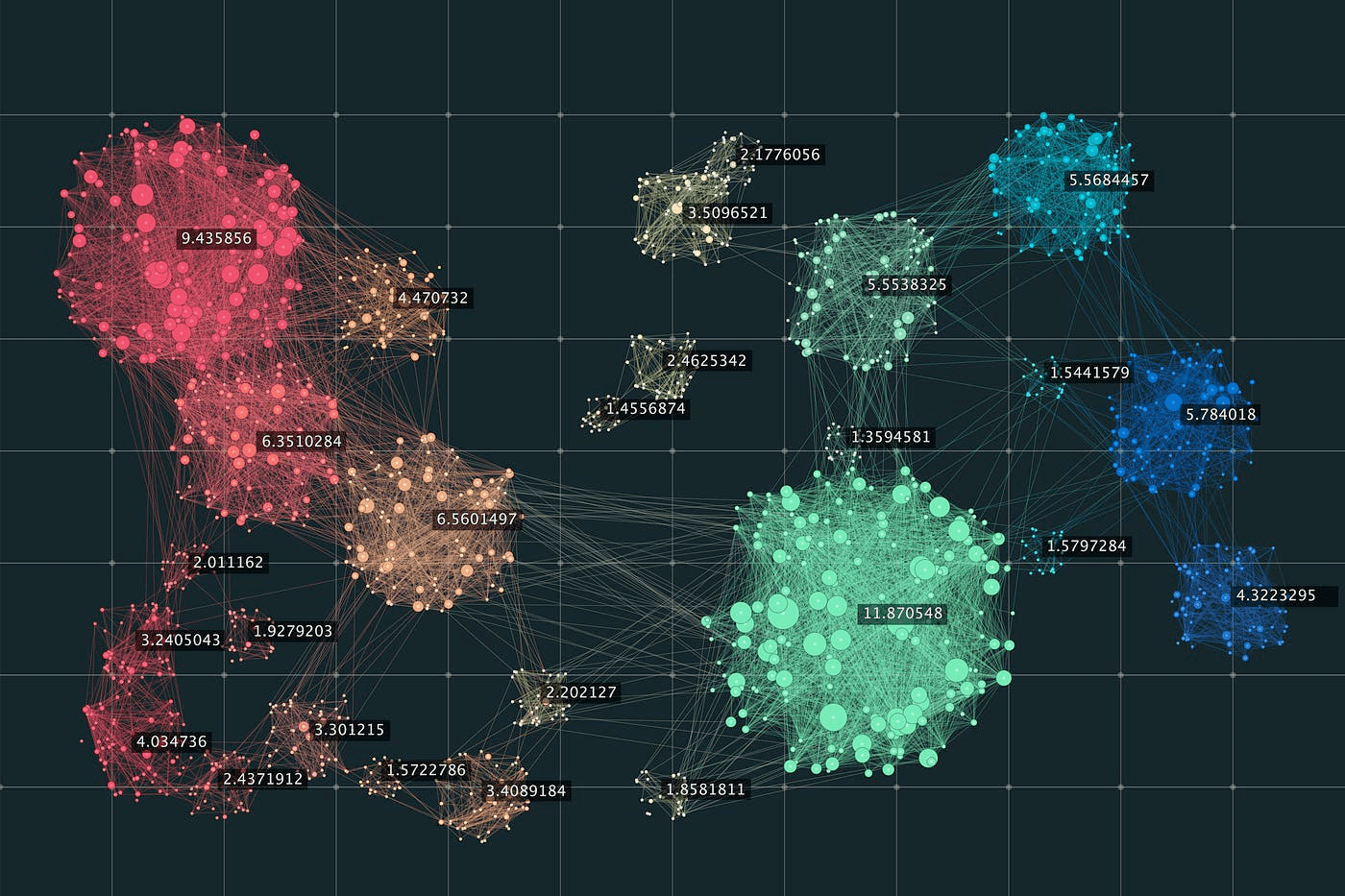

In our similarity matrix, this is determined by the spatial distance between objects. Objects closer in this dimensional space are deemed similar. Using advanced distance metrics and similarity scores, we can pinpoint the most similar comparables for any given analysis. This dynamic, ever-evolving process is further refined with each new piece of data, ensuring our model remains cutting-edge.

The graph is a simplistic illustration of how numerical attributes of an object (building) would be represented in dimensional space (graph). The clusters of points represent buildings that are similar to one another. Further, points within the clusters that are closest to one another represent the highest similarity.

Given the locational significance in real estate, our algorithms also factor in geographical constraints. This ensures our analysis remains contextually relevant, accounting for urban vs. rural settings, market temperatures, and other nuances.

DELIVERING IMPACT: THE RESULTS OF OUR APPROACH

The culmination of our approach is a holistic analysis that encapsulates the broader market sentiment. By leveraging collective insights, we can identify patterns in pricing metrics and spot deals that align with previously identified lucrative opportunities. This automated, adaptive approach not only surfaces insights that might be overlooked but also amplifies our analysts’ efficiency. As the market dynamics shift, our approach evolves, offering a balanced view of risks and opportunities. This empowers decision-makers with foresight, ensuring resources are optimally utilized and driving us towards a future-ready investment strategy.

Interested in learning more about our deal-sourcing process? Learn more about our Transit Connectivity Score.